massachusetts estate tax table

For deaths occurring on or after January 1 2006 if a decedents. A guide to estate ta mass gov massachusetts state estate tax law what is.

How Do Millionaires And Billionaires Avoid Estate Taxes

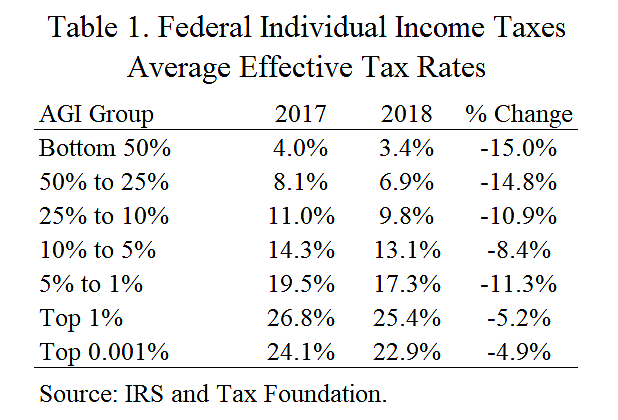

Massachusetts Estate Tax Massachusetts decoupled its estate tax laws from the federal law effective January 1 2003.

. Form M-4422 Application for Certificate Releasing Massachusetts Estate Tax Lien and Guidelines. Estate Tax Rates by State. A state sales tax.

The Massachusetts estate tax is a. A local option for cities or towns. Massachusetts Estate Tax Rates.

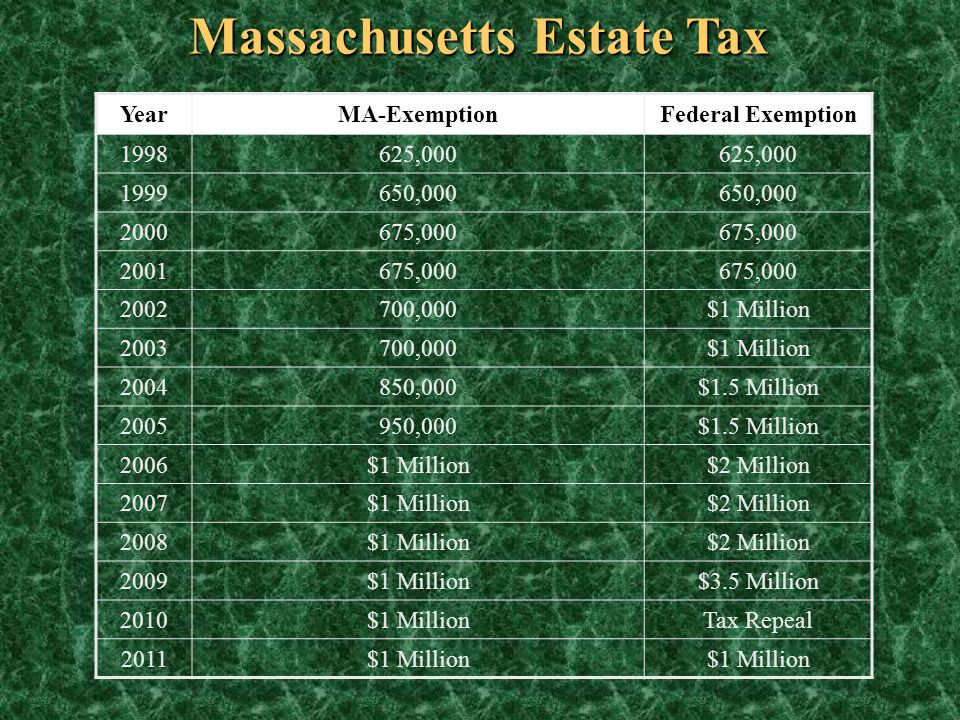

The Massachusetts estate tax law MGL. In the table below we will detail which states along with the District of Columbia have an estate tax. A state excise tax.

Masuzi March 3 2018 Uncategorized Leave a comment 52 Views. 778 NE2d 1039 Table Mass. In the administration of an estate there are many services that the personal representative formerly.

625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or. The total Massachusetts estate tax due on his estate would be 280400 or 238800 41600 104 of 400000 the amount of the estate over 3540000. The Massachusetts State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Massachusetts State Tax CalculatorWe.

The Massachusetts estate tax calculation is based on the federal credit for state death taxes in. Was enacted in 1975 and is applicable to all estates of decedents dying on or after January 1 1976. Only to be used prior to the due date of the M-706 or on a valid Extension.

This means if the value of an estate exceeds the 1 million threshold anything above 40000 will be taxed. Massachusetts Estate Tax Table. Up to 25 cash back The Massachusetts tax is different from the federal estate tax which is imposed only on estates worth more than 1206 million for deaths in 2022.

This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional. So even if your. 402800 55200 5500000-504000046000012 Tax of 458000.

Massachusetts uses a graduated tax rate which ranges between. Note that the above estate values are given after administrative and estate expenses. A Practice Note discussing the key aspects of the Massachusetts estate tax law.

Massachusetts lawmakers are considering an estate tax reform measure which would raise the threshold at which someone becomes eligible to pay. For each of the states with an estate tax we. A guide to estate taxes Mass Department of Revenue.

How is the state estate tax calculated in. Good news for small business owners. References throughout this Note to the estate tax are to the.

The Note identifies the property included in the gross estate and explains available deductions and exclusions and the tax calculation. It also discusses filing the Massachusetts estate tax and paying the estate tax. The filing threshold for 2022 is 12060000.

Example - 5500000 Taxable Estate - Tax Calc. The adjusted taxable estate used in determining the allowable credit for state death. The Massachusetts estate tax is an amount equal to the federal credit for state death taxes computed using the Internal Revenue Code Code as in effect on December 31.

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Estate Tax Rates Forms For 2022 State By State Table

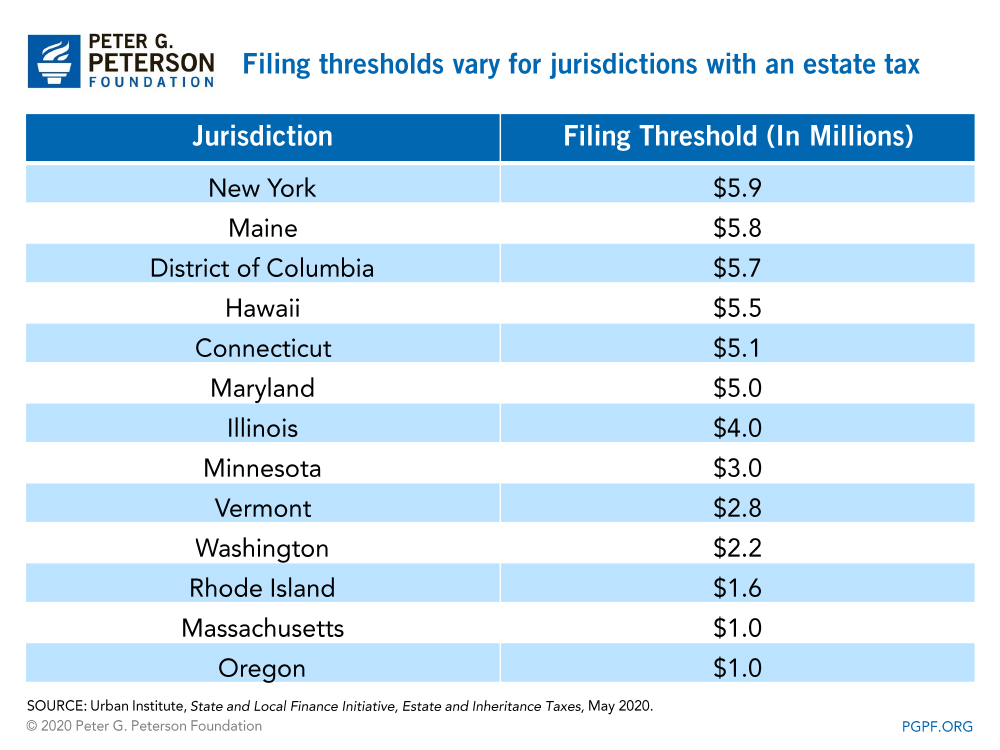

Tax Rates By Income Level Cato At Liberty Blog

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Voluntarily Pay More Taxes Few In Mass Opt For Higher Rate

Living Wills Health Care Proxies Ppt Download

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

The State Of Estate Taxes The New York Times

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Estate Tax In The United States Wikipedia

Crr Blog Accounting Tax Advisory Wealth Management Estate Tax

What Are Estate And Gift Taxes And How Do They Work

Irs Announces Higher Estate And Gift Tax Limits For 2020

Estate Tax Rates Forms For 2022 State By State Table

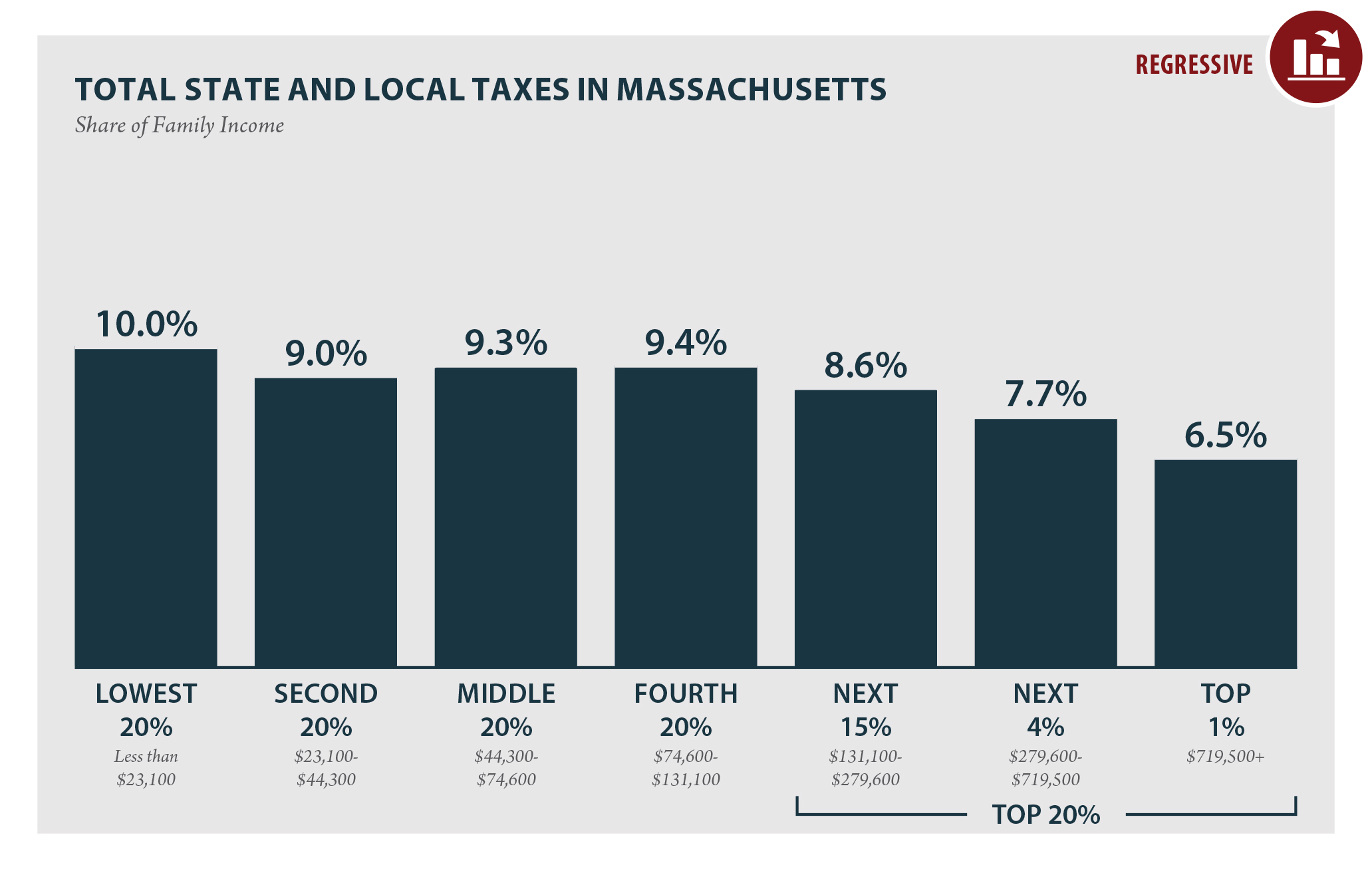

Massachusetts Who Pays 6th Edition Itep

Estate Tax In Massachusetts Businesswest

Massachusetts Estate Tax Everything You Need To Know Smartasset